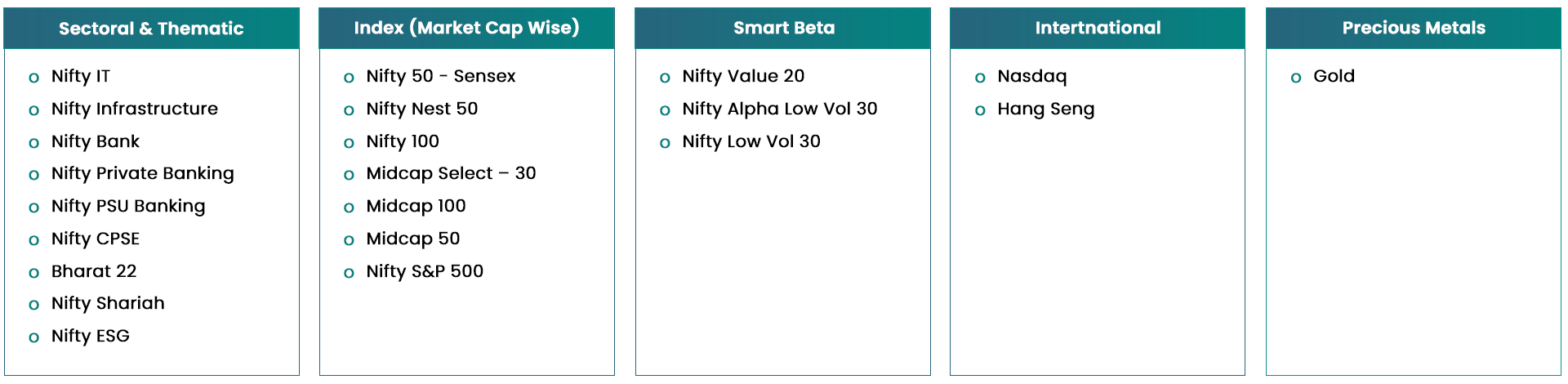

Paras Financial Servicess in collaboration with Wealth wise Solutions Pvt Ltd offers a ETF Service offers professionally Actively Managed ETF portfolio with an aim to deliver consistent returns. ETF Service relieves you from all monitoring hassles with benefits like regular reviews, strong risk management flexibility, and makes it an ideal & cost effective ETF investment avenue for Investors.

For NRI Customer kindly click here for the further information.

1500+

500+

100CR+